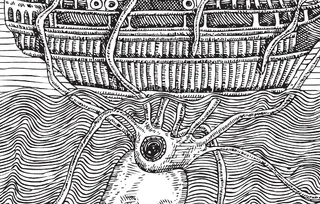

Rise of the kraken - challenges to Bermuda

Risks to the market are many and diverse and few would argue that close attention to risk and its mitigation are good business practice. The Bermuda market, with its unique concentration of capabilities and talent, faces its own particular challenges, but many also present opportunities for savvy Island players with a strong head for enterprise risk management. Bermuda Re explores a number of the leading risks faced by Bermuda re/insurers, examined in each instance by key figures in the global industry.

What danger does eroding investor confidence in traditional reinsurers pose to the Bermuda market?

Michael McGuire, chief financial officer at Endurance

I don’t believe that there has been a significant erosion in investor confidence in the Bermuda market. In fact, over the last year we’ve seen an improvement in valuations, although admittedly from a historically low standpoint. The primary driver of valuations has been global macroeconomic conditions that all property and casualty (P&C) re/insurers are facing, not just those in Bermuda.

We are in a prolonged period of challenging economic conditions. Growth has been weak and exposures have been muted, while few catalysts for improved conditions exist. That said, a number of companies are beginning to show growth and are seeing rate improvements on lines such as US specialty.

The other macro theme affecting valuations—which is probably more important for the P&C sector—is the interest rate environment. We’re now several years into globally suppressed interest rates which has had a significant impact on re/insurers who typically maintain significant levels of fixed income investments. We have benefited from the reduction in interest rates, which has helped increase the value of existing bond portfolios, but as time goes by the reinvestment rates for redeployed invested assets are lower and lower. That has an adverse impact on forward-looking investment returns. This creates a significant macro overlay that isn’t specific to Bermuda, but is a distinct negative when it comes to P&C valuations.

As to what is it going to take for valuations to improve, I don’t think it is about investor confidence. Rather, it is investors’ viewpoint regarding the financial model of P&C companies being suppressed by macroeconomic conditions. As a whole, insurers are starting to improve prices to address some of those themes, but we’re probably still a year or two away from starting to see that make a difference. But I don’t think it’s a change in confidence—it’s really just a change in viewpoint regarding the forward-looking returns of the industry.

In terms of building value in Bermuda, the Island has a number of inherent strengths. Capital flows into Bermuda are substantial, while regulatory flexibility enables companies and capital providers to quickly address dislocations in the market. Bermuda has been the domicile of choice for new capital entering the re/insurance industry,with each new iteration helping to strengthen the market’s profile, and that of the companies within it.

In terms of piquing investor interest, specialty lines capabilities can prove a key differentiator for companies. When people first enter the Bermuda market they tend to go after the most syndicated and volatile risks, but companies quickly run into capacity constraints with respect to aggregation, accumulation and capital risk. As companies look to diversify either by geography or line there’s much less correlation to the more severity-type lines of coverage that Bermuda companies are founded on, while there also tends to be lower cycle and loss volatility.

It is attractive for a severity-focused company to diversify its earnings profile and operating platform. We have done that as a company, and our focus will continue to be adding further specialty capabilities that will enable Endurance to continue to be a meaningful provider of catastrophe and severity products, and also to be a strong specialty player.

What danger does an anti-business or insular approach taken by the Bermuda government pose to the Bermuda market?

Brad Kading, president and executive director at the Association of Bermuda Insurers and Reinsurers

Governments anywhere can pose a political risk to business, not only in Bermuda. For the Island however, the potential risks relate to pay-roll tax, uncertainty over the tax treatment of business operations, limitations on work permits, and actions that do not contribute positively to the reputation of the jurisdiction—whether it is over tax, law enforcement or regulation.

"Turning to the new government, our first impressions have been encouraging. The new premier's cabinet has a great depth of experience in re/insurance, private enterprise and law and that is encouraging to any business entity on the Island."

Over the issue of work permits, there was evidence in recent years of problems that had developed with the process, whether it was exemptions to term limits or just rejections of candidates that were viewed as essential for business operations by companies on the Island. The new government is looking at this matter, and in fact campaigned on this issue, and is now working closely with the business community to resolve the issue. The new government has already eliminated term limits, which is quite a positive step for business leaders and continuity. And the new government has also taken steps to liberalise the work permit system and we regard this as a positive step. The more senior and middle management positions we have in Bermuda, the more job opportunities are created for Bermudians and work permits are an intrinsic part of what enables us to attract those managers to Bermuda.

The biggest example of political risk, which was a mistake made by the previous government, was the increase in pay-roll tax introduced back in 2010. The government—without consultation with business— increased the rate by two points, while also increasing the base to which the tax applied. It proved a major jolt to the system and had a multimillion dollar impact on companies and their payrolls in Bermuda. We complained immediately and the government rolled back the top two-point increase in the rate, but they kept the broader base to whichthe tax applied. That is something that pretty clearly increased the cost of doing business in Bermuda. Every CEO could calculate the impact.

Regarding the Island’s international reputation, we are quite positive about past and future Bermuda governments’ role in negotiating tax information exchange agreements (TIEAs). Around three dozen have been negotiated and unlike some jurisdictions where they have opted to sign the easy ones, Bermuda examined who its trading partners are and established agreements with key partners. TIEAs provide an indication of how transparent and cooperative Bermuda is as regards tax law and enforcement. Bermuda is also working with the US government on the Foreign Account Tax Compliance Agreement, which should be settled shortly; on anti-money laundering and terrorism financing, Bermuda complies with both UK and US standards.

Turning to the new government, our first impressions have been encouraging. The new premier’s cabinet has a great depth of experience in re/insurance, private enterprise and law and that is encouraging to any business entity on the Island. We are optimistic that there is more of a business orientation to the government, although we always worked well with the previous government. The new government’s focus will be on job creation, starting first by securing the employment foundation with the insurers already located here.

What danger does a prolonged low interest rate environment pose to the Bermuda market?

Jed Rhoads, president and chief underwriting officer of Bermuda reinsurance for Alterra Capital

In an industry that has typically seen investment returns as an important—and often telling—factor in the profitability of its business, the financial collapse of 2008-2009 and the protracted low interest rate environment that has followed have raised serious concerns. The situation has raised questions regarding where investors can eke out additional returns, the risk:return profile of potentially more profitable instruments and the security offered by formerly safe instruments. Re/insurers have been forced to answer these questions and many more, as they have sought to maximise investment returns in an environment further constrained by an underwriting environment many reinsurers characterise as soft.

One of the leading threats posed by a protracted low interest rate environment results from the associated entrance of increasing levels of capital into the reinsurance arena, where the capital markets see the potential for enhancing returns by investing in assets with little correlation to more traditional instruments. This is particularly true in the property catastrophe space, said Jed Rhoads, president and chief underwriting officer of Bermuda reinsurance for Alterra Capital. “The major threat posed by such capital is that it has the potential to dumb down industry capabilities. But that is not just a concern for Bermuda, it is something that will also affect leading markets such as Lloyd's, as well as Europe and the US."

Additional capacity entering the catastrophe space will inevitably drive pricing down, in a classic supply and demand dynamic, encouraging some re/insurers to consider other lines of business. Bermuda players, with their leading position in global property cat business, may well be tempted to turn to other lines in order to strengthen their returns, said Rhoads. “If companies write less property cat business, they will look to other classes, but by capital moving around and into other areas, it can dumb down returns” and the strength of intellectual capital.

“A prolonged low interest rate environment represents not only a threat to the Bermuda market, or to short-tail lines, but to long-tail and specialty business and markets generally.” Should the current macroeconomic situation persist, the movement of capital and the entrance of hedge and pension funds into the more instrument-driven and easily understood parts of the reinsurance landscape, could create challenges for Bermuda and the wider market.

Nevertheless, for current Bermuda reinsurance players with high levels of intellectual capital, the situation provides some real opportunities. Rhoads commented that “Bermuda has a unique opportunity to capitalise on the availability of third party capital seeking exposure to the reinsurance markets. The Bermuda regulatory and tax environment, as well as the concentration of underwriting expertise, makes the Island the natural choice for investment in nontraditional reinsurance structures, such as insurance-linked securities (ILS) and sidecars.

As a result, a number of Bermuda reinsurance companies have formed sidecars that have been established to create additional capacity for the property catastrophe collateralised reinsurance marketplace, while others have set up operations to manage investments in ILS. Alterra itself recently formed New Point V, the fifth in its series of successful sidecars. These vehicles have enabled Alterra to provide increased levels of property catastrophe reinsurance to our clients, while generating additional income for Alterra. In essence, we have benefited from providing investors with access to our well-established property cat underwriting capabilities.”

What danger do rising levels of alternative reinsurance pose to the Bermuda market?

Brian Schneider, senior director at Fitch Ratings

Convergence of the reinsurance market and capital market persists, with Bermuda leading the way as both a provider and user of alternative forms of risk transfer to supplement the traditional balance sheet. These structures include catastrophe bonds (cat bonds), collateralised quotashare reinsurance vehicles (sidecars), and asset managers investing in ILS. As such, several Bermuda re/insurers are transforming into risk asset managers.

Favourably for the Island, Bermuda is the preferred domicile of choice for many of these special purpose insurers, given the country’s regulatory environment, lower operational entry barriers and concentration of underwriting talent and capital resources. However, as these alternatives have become regarded as the more efficient and flexible preferred option to manage capacity, Fitch does not expect Bermuda to benefit from another sizable wave of start-up re/insurers following a significant catastrophe event, which last occurred with the class of 2005.

Fitch views the growth and acceptance of alternative reinsurance as somewhat of a mixed benefit to Bermuda re/insurers’ credit ratings and financial strength. Positively, the alternative reinsurance market can be a source of fee income for reinsurers that underwrite or providemanagement services for such transactions. Furthermore, the nontraditional reinsurance market can also be used by reinsurers to manage their exposure, transfer risk, and reduce capital volatility, similar to the benefit provided to primary insurers.

"The Bermuda regulatory and tax environment, as well as the concentration of underwriting expertise, makes the Island the natural choice for investment in non-traditional reinsurance structures."

Negatively, the market represents competition for reinsurers from the increased supply of capacity to the insurance industry. This availability of capital from both the traditional and alternative reinsurance market has served to meaningfully dampen the reinsurance pricing cycle in recent years, even with record catastrophe losses. This is evidenced by reinsurance broker Guy Carpenter’s Global Property Catastrophe Reinsurance Rate on Line Index (where rate on line is defined as premium divided by contract limit) which is essentially flat from where it was five years ago, with the modest annual rise in rates experienced after the catastrophe loss events of 2008 and 2011, offset by rate declines in the other three years.

Cedants that have demonstrated to the market that they are willing and able to utilise alternative forms of reinsurance capacity are benefiting from the downward pressure that having diversified sources of reinsurance places on the cost of traditional reinsurance to the company. While this competition between the traditional reinsurance market and the ready and waiting capital market is reducing the volatility of rates after a large catastrophe, the ultimate level of impact is also heavily dependent on the other fundamental factors that drive the re/insurance underwriting cycle.

What danger do further redomestications pose to the Bermuda re/insurance market?

Arthur Wightman, partner—insurance leader at PwC Bermuda

The question of domicile is omnipresent on the board agenda of any globally-focused company. Although capital management, regulation and tax are significant considerations, market access and positioning are often at the top of the list. It does not mean the first three considerations are less important, but it is an often portrayed misconception that companies are running scared from the protectionist bully looking for a slice of the economic pie. The reality is that global organisations are just that—they constantly evolve, change shape, move positions—their loci define a modelthat executives determine will best serve to maximise shareholder value and to move forward other key strategic objectives of the organisation. It is therefore critical to see domicile choice as part of the DNA of a global organisation—and while jurisdictions can position their advantages—ultimately it is down to what suits the company in question and not the other way round. That is why Hiscox chose to invert from London to Bermuda while Lancashire went the other way.

In considering a domicile choice and Bermuda, the value proposition is what is key. Bermuda commands the world’s top spot for captive insurance and the third spot for reinsurance. This is owing to an innovative and nimble approach to foreseeing opportunity through crisis, whether that is the liability crunch, large hurricane events, or tragedies such as September 11th, and further, providing an environment where carriers could be rapidly established or capital could flow quickly into existing carriers.

Proportionate regulation, ease of access to markets and the provision of a live marketplace and talent are complemented by an attractive tax position and infrastructure. These factors play a supporting role, though, to the real differentiators—entrepreneurial ability and intellectual capital that exists, which can quickly source and capitalise on opportunity. As the reinsurance landscape and global economic flows evolve, Bermuda has come out on top with another reinvention. It is now widely recognised as the convergence capital of the world – this has stimulated capital flows to Bermuda in the billions of dollars in the last six months, some in the form of short-term capital and some behind companies looking to establish a foothold on the Island and grow their businesses.

With so many jurisdictions, emerging or established, trying to lure companies from Bermuda, the territory must continuously evolve to retain them. By being distinctive and proactive, but also by having a secure, well understood and proven track record, it is no wonder why many struggle to do so. And this is why a feared exodus failed to materialise in the mid-2000’s and the level of incorporation today is testament to the Island’s sustainability across the markets it serves.

What danger does the pursuit of scale pose to the Bermuda re/insurance market?

Stuart Shiperlee, partner at Litmus Analysis

Be acquired or grow has become the established pattern for those ‘classes of’ that have launched in Bermuda since 1992. Since the launch environment has invariably been an extremely attractive, but unsustainable, pricing environment in the immediate aftermath of major cat losses, this is pretty much inevitable for all but a few able to sustain a specialist niche.

The degree of success represented by the acquisition option is clearly specific to the transaction. For the growth option however, generic risks are all too clear.

If the impetus for consolidation is declining (or declined) rates, then growth into the same business line for a relatively small player effectively means price-based competition from an already unattractive level. The alternative is to seek the seductive ‘grass is greener’ uplands of diversification.

"With so many jurisdictions, emerging or established, trying to lure companies from Bermuda, the territory must continuously evolve to retain them."

This is a well-trodden path. It not only appears to offer the hope of growth away from an existing and highly competitive market, but also appears to tick the diversification box for shareholders (which in practice they may well not actually want), equity analysts and rating agencies. The circular logic applied to the latter being ‘if we can diversify it will improve our rating thus giving us access to better and different business’.

The flaw in this argument is that this is not how the agencies see it. Indeed, ‘we need to diversify to satisfy the rating agencies’ is one of the primary myths of the reinsurance industry. The confusion comes from the impact a lack of diversification has on a reinsurer’s risk adjusted capital calculation in the agency capital models and their associated view on the quality of operating performance (which is impacted by their assumption of overall underwriting result volatility). To assume a lack of diversification limits a rating is correct, but to assume moving into new lines solves the problem is not.

Rating agencies have watched numerous examples of specialist reinsurers seeking to diversify only to get burned in the process. For them the default assumption is that any given line of business is a zero sum game. If a moderately-sized reinsurer is not already in a particular line of business then it will struggle to offer something genuinely new and so it will necessarily compete on price. If established market participants let the player win business that way, then they clearly don’t want it themselves. And they probably have a much better idea than the new entrant does of what business to compete for and what they should happily let it take.

For the Bermuda market therefore the best solution must surely be reinsurers who grow by consolidation or who stick to their specialty knitting even if that means forgoing growth.

What danger does a major hurricane landfall in Bermuda pose to the Bermuda market?

Jeff Waters, senior analyst, models and analytics product marketing at RMS

The RMS Hurricane Model is a geographically holistic platform for modelling hurricanes across the most vulnerable countries and territories throughout the Atlantic, including Bermuda, an Island where hurricanes are the principal driver of annual catastrophe risk. Since its original release in 1999, the model has undergone several major enhancements and upgrades. Most updates have been driven by the acquisition of new hazard and loss data, advances in research and hurricane modelling technology, or industry underwriting practices.

The most recent version of the model was released in 2011. It combines high-resolution modelling and insurance claims data with innovative meteorological and engineering research to provide underwriters and portfolio managers with a comprehensive, realistic, and advanced view of hurricane risk.

According to the latest version of the RMS Hurricane Model, the Bermuda re/insurance industry has the potential to be significantly impacted by a Category 5 event from a wind-only perspective (the model does not include storm surge for Bermuda).

An assessment of the most recent RMS Bermuda Industry Exposure Database using the RMS reference view (medium-term event frequencies, default vulnerability assumptions with post-event loss amplification) indicated that the top five loss-producing events in the model’s stochastic event set are of Category 5 severity. The building stock of Bermuda is well designed against hurricane force winds—with their famous limestone roofs offering a very high degree of wind resistance—as tested in Hurricane Fabian in 2003. From an insured-loss perspective, the wind-only impacts of these tail events range from $10 billion to $16 billion industry-wide, of which just over 50 percent is attributed to residential lines of business, with commercial accounting for the majority of the rest of the risk.

Although the likelihoods of these types of low-frequency, highseverity events are relatively small, being aware of the tail wind risk in Bermuda highlights the value of a resilient risk management framework. This emerging paradigm in catastrophe risk modelling explicitly considers uncertainty and ongoing learning to better inform long-term insurance strategies, ultimately enabling re/insurers to develop a more complete view of the risk landscape.