The road ahead: 2020 predictions for Bermuda and ILS

Insurance-linked securities (ILS) on Bermuda have had an interesting few years, as the market continues to evolve to meet strong demand.

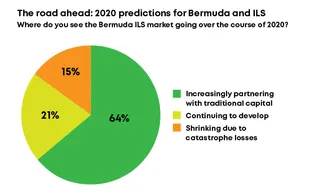

Over the course of 2019 demand was still brisk, but there were the occasional fluctuations due to losses from natural catastrophes. As a part of our series of articles based on a survey filled in by Bermuda:Re+ILS readers we asked the question ‘Where do you see the Bermuda ILS market going over the course of 2020?’ Respondents could pick only one answer.

Only 21 percent of readers said that the ILS market will continue to develop in 2020. As Bermuda:Re+ILS reported in October, while the ILS sector continues to grow and innovate, investors’ insistence on the use of tried and tested risk models, combined with a wariness of new risks, is holding the market’s development back, some cedants claim. ( https://www.bermudareinsurancemagazine.com/article/buyers-bemoan-ils-need-for-models)

The majority of readers—64 percent—said instead that the ILS market will increasingly partner with traditional capital. In this year’s Convergence event on Bermuda that was a theme that many speakers mentioned, with Kathleen Faries, chair of ILS Bermuda, making it a key part of her address to delegates. Faries said the lines are blurring in the ILS market, with a converged version of ILS having emerged—a trend she said she hoped would continue. ( https://www.bermudareinsurancemagazine.com/news/convergence-ils-no-longer-a-threat-to-traditional-capital-5116)

Commenting on this option in the survey, industry veteran Andrew Barile said he predicted that each traditional reinsurer will have in its financial group an ILS firm, rather as Markel has after its purchase of Nephila Capital earlier this year.

Only 15 percent of readers predicted that the ILS market on Bermuda would shrink due to catastrophe losses. 2019 has been another year of quite high catastrophe losses, but lower than some recent years. No powerful hurricanes made landfall over the US coastline this year, unlike in 2017 and 2018, although the ongoing Californian wildfire season as well as the deadly Australian bushfires may be making some people rather nervous.

It has to be said that there is a lot more optimism than pessimism discernible in the ILS market on Bermuda at the moment. At this year’s Monte Carlo Rendez-Vous Greg Wojciechowski, chief executive of the Bermuda Stock Exchange, was bullish about the state of the ILS market in 2019, saying that he believes Bermuda remains the natural location for this asset class to continue to evolve and develop.

In November Aon Securities, Aon’s investment banking division, launched Randolph Re, a new private placement catastrophe bond platform. Randolph Re broadens the scope of Aon’s ILS offering, providing clients with a dedicated platform to execute private placement transactions above $25 million in issuance size.

The private placement catastrophe bonds will be issued via a special purpose vehicle called White Rock Insurance Bermuda. ( https://www.bermudareinsurancemagazine.com/news/aon-unveils-randolph-re-its-private-placement-ils-platform-5263)